Subscribe to our site to receive the latest offers

And real estate cuts in Turkey

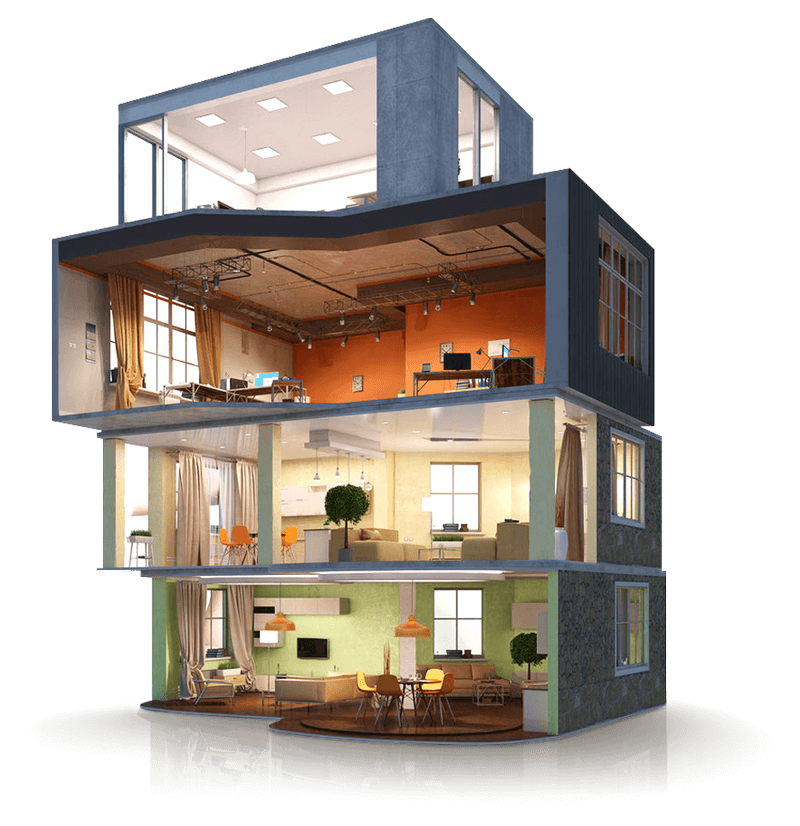

One of the popular investment ideas in Turkey is to purchase a commercial store that is pre-rented to an international brand or a hotel that is already occupied by visitors. Here are the unique advantages of commercial real estate:

The annual return on commercial property is higher than that of residential property.

The commercial property has a rental guarantee for several consecutive years.

The rise in the price of commercial real estate is inevitable, especially if it is leased to international brands.

The advantage of owning a store in a large mall, means an inevitable price increase.

With its geological, socio-economical, and cultural fabric have been an excellent option to invest in Turkey in the past years. Existing economic practices are centered on encouraging and supporting foreign investment. Furthermore, several improvements in foreign investment laws have been developed to make investment more appealing in Turkey and to make the investor's work simpler. Thanks to the economic and legal changes, foreign investors may now conduct practically all of their business remotely by designating a proxy in Turkey rather than coming to the country directly. Investors can complete some of the procedural procedures through the internet. They may establish a business in Turkey in less time and for less money, without having to travel frequently or cope with governmental formalities.

The answer is yes, and there are several investment opportunities in Turkey for those who choose to do so. Depending on how the investor enters Turkey, different investment alternatives are advised. If the investor comes as a real person, he or she can be a partner in a corporation registered in Turkey, become a partner by acquiring the shares of a Turkish firm, purchase real estate, invest in fixed capital, or acquire securities. And if the investor comes as a legal person, he/she can start a new company, open a branch, open an advisory office, or become a partner in a company in Turkey through his/her firm formed abroad. Whatever the case is, the most beneficial sort of investment should be selected based on the investor's intentions and preferences, with the goal of obtaining the highest profit at the lowest possible cost.

Turkey possesses many of the characteristics of a good investment location, in addition to being a popular tourist destination with affordable real estate costs and a robust resale market.

Turkey has also attracted a substantial amount of foreign investment. Turkey's infrastructure has been extensively upgraded because of this investment. Private investors are developing new resorts and other tourist amenities, while government funds are being utilized to enhance highways and airports. All of these are clear evidence of a thriving tourism economy, which boosts capital growth for today's property investments.

Furthermore, over 25 million tourists visit Turkey each year, boosting the property market and creating strong "buy to rent out" possibilities. Gross rental yields in Turkey vary from moderate to high. Properties in major city centers offer yields of 7.6%, while properties in coastal areas can yield anywhere from 13% to an impressive 16%. The low cost of living and affordable and frequent flights from most European cities make the country an easy place in which to have a second home. In short, Turkey has a lot to offer a potential buyer, whether it's for business, retirement, or just a vacation house.

Not to mention, the Turkish estate market's robust capital growth implies that investors hoping to profit from property investments in emerging economies should keep an eye on Turkey. Since 2013, Turkish property values have soared by more than 100% in numerous places, and by as much as 150% to 200% in major city cores. Property for sales in Turkey have surged, with over 21,000 purchasers from the United Kingdom, Ireland, Germany, and the Netherlands investing in properties along the Turkish shore.

Turkey is a very successful location when compared to most Western European and some Eastern European countries, with an annual capital growth of 25% and an average lease income of 7.6%.

Turkey was always preferred due to its hegemonic location and hospitality. These features, among many others, have piqued the curiosity of investors, and the city has become a major hub for attracting local and international investors in a range of industries besides tourism and real estate. Turkey is a stunning and distinct country, rich in history, culture, and legacy. But this isn't the only thing Turkey is recognized for. Turkey provides investors from all over the world with several safe and secure investment options. When you consider investing in Turkey, you will undoubtedly discover a slew of advantages. However, let us hereafter look at a few that are particularly convincing.

Turkey serves as a natural gateway connecting Asia and Europe, and that has had an impact on Turkey's diverse culture. When it comes to providing strategic access to all of the sectors' main markets, Istanbul is the key. According to data, Turkey has access to 955 million customers through FTAs and the Customs Union. The majority of investments have gone towards Istanbul, which is Europe's seventh most-invested city.

In recent years, the Turkish economy has experienced unprecedented expansion. From 2003 to the end of 2020, it was rated the 13th best in the world, climbing from 18th place in 2013 to 11th place in 2020. According to the ranking of economies by GDP, Turkey came in at 13, after China, which is the first in the world in terms of purchasing power parity (PPP), followed by the USA, India, Japan, Germany, Russia, Indonesia, Brazil, France, and the UK.

Turkey, particularly Istanbul, has a thriving entrepreneurial ecosystem comprised of startup co-founders and founders. This demonstrates that there are several options for collaboration and networking. Startups at various stages of growth may readily engage in entrepreneurship-focused events, accelerator programs, industry events, co-working spaces, and symposiums. Businesses from across the country may swiftly learn from one another, build something new together, and meet together thanks to hybrid or newer technological formats of programs and activities.

The Turkish government has planned a number of investments for the FDI investment policy for the years 2021–2023. They accomplished this by assessing all of the most recent investor preferences and demands and tailoring their activities and strategies correspondingly. All of this is part of a bigger strategy to attract all foreign investments and to develop inducement-based entity classifications that will be available to all expert investors. The quality of FDI defines seven investor categories, according to Turkey's Investment Office. Investments that reduce import dependence; investments that provide technology and knowledge transfer; investments that provide employment incentives; investments that support digital transformation; investments that provide high-quality employment; and investments that are export-oriented are some of the profiles that all investors will encounter.

Turkey's energetic and literate population is a desirable asset at a time when investors elsewhere in Europe encounter substantial hurdles owing to population aging and contraction. Turkey offers considerable prospects due to its increasing, youthful, and lively population, which is the driving force behind a healthy labor force and a valuable national economy. Turkey's populace was estimated to be 82 million in 2018. It is expected to hit 86.9 million by 2023 and 100.3 million by 2040, as per the National Institute of Statistics. The population is predicted to grow until 2069, when it might total 107.6 million people.

The presence of required infrastructure and the low cost of transportation are two of the most persuasive advantages for foreign investors to invest almost everywhere. Turkey's essential infrastructure, such as transportation, communications, power, and technical infrastructure, has grown in recent years, making Turkey a great choice for international investment.

The real estate and construction industries are flourishing as a result of the fast population increase and municipal regeneration initiatives. The construction and real estate sectors continue to entice and motivate investors.

Acquiring properties in Turkey is, in many respects, the safest way to invest. Turkey has also been a popular retirement destination for foreigners, resulting in the development of Turkey's real estate market.

In Turkey, foreign investors may form any of the types of firms listed in the Turkish Commercial Code. The investor is entirely free to conduct business in whichever area he or she desires and to establish whatever type of firm he or she chooses. All current prohibitions on foreigners' lines of business and fields of activity have been lifted.

According to Turkish commercial law, there are two kinds of companies: equity companies and sole proprietorships. Equity firms include joint stock companies, limited companies, limited partnership companies, and cooperatives. Sole proprietorships, on the other hand, are regular companies, general partnerships, and limited partnerships.

The following is a quick rundown of the most common corporate types:

A joint stock company is a form of financial firm with a legal identity that has a fixed capital that is split into shares. They can be created using one of two capital schemes: original capital or registered capital. A joint-stock corporation with original capital must have a minimum of 50,000 Turkish liras in capital. It is feasible to create a joint stock firm in Turkey with at least 100,000 Turkish liras if the registered capital mechanism is used. Every share has a monetary value. The company's capital is calculated by multiplying these monetary values represented in shares by the number of shares. The number of shares in the firm is decided by the founding members.

A joint stock company can be formed with one or more partners. There are two sorts of joint venture companies: closed and public. Joint stock businesses having a small number of shareholders are known as closed joint stock corporations. The number of partners in public joint stock firms is larger. Aside from the business founders, there is a group of people that are engaged in the firm. There is no limit to the number of partners you may have. On the other hand, joint stock corporations with more than 500 shareholders are deemed public by law. This implies that business shares will be able to be exchanged on the stock market of Istanbul and will be governed by the Capital Markets Law. Company partners own a percentage of the company based on the value they add to the capital. To put it another way, owning a piece of the firm entails becoming a partner in it. Dividends are distributed to partners depending on the profit earned in proportion to their share of the profit.

Joint stock corporations can be formed for any economic purpose and under any circumstances that are not forbidden by law. In order to undertake business in some fields, Turkish legislation requires the formation of a joint stock company. Banking, insurance, brokerage houses, and investment partnerships, as well as financial leasing firms, public shops, financing, and factoring companies, must be formed as joint-stock companies.

The firm is exclusively liable for its own obligations, which are restricted to its own assets. Partners are not personally accountable for the company's obligations. The company's partners are only obligated to pay the amount of cash they have agreed to deposit into the company's founding stage, and the partner who covers the capital investment debt bears no liability for the company's debts. Investors in joint stock corporations are only at risk of losing the funds they have contributed to.

It is a solo form of ownership with a legal identity, whereas a collective company may only be established by natural individuals. There is no minimum amount of money that must be invested in the firm. It can be formed by the collaboration of at least two natural individuals, and the company's assets are principally liable for the company's debts. For obligations that cannot be paid with assets, each partner is unlimitedly accountable according to their own assets for all of these debts.

This type of companies requires the participation of at least two people, one active and the other inactive. Natural individuals are active partners, whereas legal or natural persons can be inactive partners. This division of partners was formed in accordance with the rules of debt obligation. The active partner bears unlimited accountability for the company's debts as well as all of his or her assets, whereas the dormant partner bears limited liability for the debts. There are two kinds of limited companies: ordinary limited and shared limited.

This type of companies is the most basic sort of business. It does not have a legal structure and can be formed with at least two partners. There is no need for a method to start the corporation; purely verbal agreement is adequate. There is no minimum amount of capital required, and because the business does not have an autonomous personality apart from the partners, all of the partners collectively own the firm's assets. Each partner is individually accountable for all of the company's debts in perpetuity, using their own assets.

To create a firm, a foreign investor does not require authorization or approval from anybody. E-TUYS (Electronic Incentive Application and Foreign Capital Information System) is adequate to notify the General Directorate of Incentive Implementation and Foreign Capital by electronically transmitting corporate information. E-TUYS may be used to send capital, share transfer, and activity information reports. Aside from that, the corporation must follow the essential processes for its formation.

In Turkey, company formation procedures are handled using the MERSIS central registration system. For transactions, the foreign investor must first get a tax number from the tax office. A passport number can be used to identify a foreign investor as a partner or officer of the firm. Then he or she should go to the Trade Registry Office and ask to be included in the MERSIS system as a user. In MERSIS, articles of association are written in Turkish. The company's prospective ID number is also issued automatically by this system.

The formation of joint-stock, limited liability, limited, and collective companies is accomplished through a registration procedure that takes place at the Chambers of Commerce's Trade Registry Offices.

To start a business in Turkey, the name, topic, headquarters, directors, capital, and shares of the company should all be determined in the contract, as well as the articles of the association. Furthermore, the partners or representatives designated by the notary public should sign the contract, and their signatures should be confirmed by the notary public. All documents issued abroad are annotated and authorized by notaries or consulates. Then, the trade register directorates approve the signatures of those who are allowed to sign on behalf of the company title. At least a quarter of the capital pledged in joint-stock companies with the competition institution's share should be placed in a bank account established in the company's name. All certified papers and contracts must be entered into MERSIS, the Trade Registry Office's computerized database. In the last phase, a request is filed to the Trade Registration Office to register the firm in the trade registry. The firm is formally formed at this point.

Following that, transactions such as commercial book approval and tax plate receipt are accomplished. The paperwork and transactions necessary during and after the establishment differ depending on whether the foreign investor is a natural or legal person.

A translated and notarized copy of the foreign investor's passport and a possible tax number must be supplied in addition to the foregoing in order for the foreign investor to form a company in Turkey or take over the shares of a Turkish firm. He or she should also open a bank account with the tax number in hand. A work permit is required if a natural person wants to start a sole proprietorship (such as a collective, joint venture, or ordinary corporation). He or she must apply for a work permit after five years of residency with a residence permit and receive a positive result at the conclusion of the five-year period. However, members of a joint-stock company's board of directors who do not reside in Turkey, as well as foreign partners of limited liability firms who are not authorized, are exempt from obtaining a work permit.

The investor legal entity must additionally present the original and notarized translation of the apostille annotated activity certificate issued by the chamber of industry or commerce, consulate, or authorities where the firm is registered, in addition to the company establishment papers specified above.

It is also feasible for a foreign investor to invest in Turkey by purchasing existing firm shares rather than forming a new one. The investor must produce a translated and notarized copy of his passport as well as his tax number in order to take over the shares.

Because registered and bearer share certificates may be produced in joint-stock firms, the transfer of shares is feasible when the certificates are transferred and the accounts are cleared. The transfer of shares in a joint-stock company is free and unrestricted. On the other hand, in order to transfer shares in a limited corporation, all past and present partners must sign the transfer agreement, which must be authorized by the notary public and the firm's general assembly. The share transfer agreement and the general assembly's approval must be filed and announced.

A foreign investor corporation may also consider establishing a branch in Turkey. Branches are created under the umbrella of the parent corporation and are restricted in scope and duration. In this case, the new branch will not have its own identity and no minimum capital will be required to open it.

However, much like corporations, the registration of branches in the trade registry office is a must. To do so, the investor must submit an application to the Trade Registry Office together with the required documentation. It is always feasible to restore a branch's earnings to the parent corporation. Although the branch earnings paid to the head office are subject to a 15% dividend withholding tax, double taxation agreements may reduce this rate.

Only market and feasibility assessments can be conducted through liaison offices established in Turkey. They are prohibited from engaging in commercial activities. To open a liaison office, you must first get approval from the Ministry of Industry and Technology.

A maximum of three years of activity is addressed in the proposal for the liaison office. Offices that want to keep operating after the three-year period must apply to the Ministry of Industry and Technology's General Directorate of Incentive Practice and Foreign Capital.

Foreign investors can utilize foreign currency in Turkey for sales, rents, hiring, licensing, consultancy, and service contracts, such as brokerage, air transportation agreements, and contracts with government organizations.

Foreigners can open up employment and service contracts in foreign currency with branches, representative offices, liaison offices, companies in which they directly or indirectly own 50% or more of the stock or have joint control, or companies over which they have control that are employers or service recipients.

Turkey is an ideal investment destination due to its energetic, vibrant, and competent workforce in a country with a population of about 80 million people. Aside from that, the government's incentives, tax exemptions, and free land allocations are enticing investors to Turkey.

When analyzing the globalizing world conditions in recent years, foreign investment in Turkey in 2021 exhibits diversity. Due to its strategic position and high profits, Turkey is one of the top choices for investors from all over the world.

Let's have a look at the most prosperous and secure investment sectors in Turkey since 2018.

It is critical to invest in the correct real estate if you want to invest wisely and earn a return on your money. The first goal of making a wise investment is to conserve your assets and evaluate them so that you may profit from them. You may also wish to make purchases to fund other assets or to meet unanticipated needs. To summarize, you can seek to make a profit and keep it worthwhile, also converting it into cash as needed.

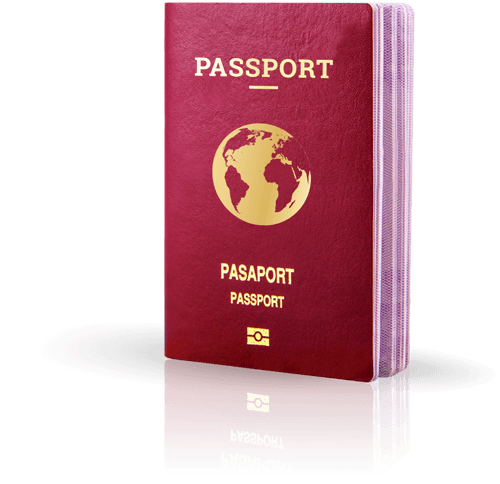

Turkey grants foreigners the opportunity to acquire citizenship if they purchase real estate in Istanbul for more than $250,000, which has boosted real estate and residential sales in the country. You can gain Turkish citizenship by acquiring any sort of real estate worth $250,000 in any area of Turkey, including flats, detached homes, villas, commercial units, stores, offices, and land. You can also get a Turkey resident permit and visit Turkey without needing a visa if you buy property below this price. Foreign investors, however, do not require a residence permit to acquire real estate.just looking for the fit real estate like, apartment for sale in Turkey , Duplex apartment for sale in Turkey , Luxury Penthouse For Sale in turkey , Offices - commercial property for sale in Turkey , Shops for sale in Turkey , Villas for sale in turkey, and lands.

You may buy three or two units for a total of $250,000 and rent them out. Rents in cities like Istanbul, Bodrum, Mugla (Fethiye), and Antalya are high, so you may anticipate a good return on your investment.

Turkey has placed a high priority on technological research and development in recent years. Many Turkish colleges now include a technology department, which makes it simpler for investors to enter the sector.

Turkey is an excellent investment destination, particularly for those looking to invest in software development, biotechnology, nanotechnology, and electronics. Despite the fact that the IT and technology sector employs a large number of domestic and international enterprises, there are still several market gaps and possibilities.

Istanbul is among the most important tourist destinations on the globe because of its historical and cultural significance. It is home to several of the most prominent religious sites for many religions; the Hagia Sophia and Blue Mosque are the most renowned. In addition, Istanbul offers a wide range of tourist and recreational attractions, bringing millions of people each year to spend their holidays here. For all of these reasons, foreigners seeking good yields and relatively safe investments have turned to the tourism sector as one of their most important assets. You may get into this sector through a number of commercial ventures, including hotels, restaurants, and others.

In terms of never-ending pursuance, the energy industry is a critical component of nearly all economic activities. In this regard, Turkey's energy deficiency is estimated to be 130 billion dollars, and the country is anticipated to invest to reduce the gap. In 2020, the energy industry received about $2 billion in investment. Turkey's growing interest in the energy and natural resource industries is reflected in the generous incentives offered to investors in these industries. Investors in hydroelectric power, wind energy, solar energy, natural gas, bio-energy, and geothermal energy can benefit from a number of incentives, including VAT exemption, customs exemption, tax discount (40 percent), employer share of social security contributions (7 years), and interest support (up to 700.000TL).

The Istanbul stock exchange is a platform where trades are conducted through a facilitator. Strength of character, skillset, and understanding, as well as some other major tactics, are necessary to succeed in this industry. In the volatile stock market, it is critical to invest in and get knowledge of a variety of industries and firms. The Istanbul stock exchange, which is more vulnerable than the real estate market, swings a lot. However, this market may provide substantial returns to investors if they make the appropriate movements.

The health sector is one of Turkey's major revenue generators. The significant expansion in the health-care industry in Turkey, notably in Istanbul, has enticed many global investors to engage in the Turkish health-care business. Around a million medical tourists come to Istanbul each year for a range of cosmetic procedures, the most renowned of which is hair transplantation. The health business, in particular, is appealing to foreign investors looking to invest in Istanbul because it gives access to high-quality services at cheap prices. Meanwhile, the medical tourism sector has grown to be one of Turkey's most important sources of revenue, and the Turkish government has given it special attention, developing a comprehensive medical zone in Istanbul and enabling both foreign and Turkish businesses to take an active role in it.

The Turkish textile and clothing sectors also offer several benefits, such as the quality provided, the abundance of raw materials, the capacity to satisfy particular requirements, adaptability, and the benefit of Turkey's position with regards to significant demand in Europe and the Middle East. As a result of these factors, the fabric sector will remain lively and appealing to investors.

Not to mention the present incentive program for individuals ready to invest in the textile sector that began in 2019. Aside from that, investors, particularly those in textiles in the country's eastern regions, should be given additional incentives to attract them.

Significant measures are being taken to address the devastation caused by industrialization as well as to avoid harmful emissions. This increases the importance and interest in the environment and recycling sectors. As global warming is a critical issue for all of us, the government has stated that it would spend around 7 to 9 billion euros on this industry.

Turkey will aid domestic and foreign investors in recycling by cutting value-added tax, import duty, investment allocation, interest assistance, tax reduction, and a range of other measures. For those reasons, this industry is considered a wonderful alternative for investors looking to make a wise investment in Turkey.

This is another good alternative for foreign currency investing in Turkey. You can invest in the Forex market by opening an account with a brokerage firm of your choosing. After that, you may use your deposit to make transactions from any computer, tablet, or smartphone connected to the internet. The most significant distinction between the Forex market and other markets, such as the stock market, is that it may be traded in both directions. For example, in order to benefit from the stock market, an investor must first acquire the product. With his deposit, the investor can buy and sell whatever he wants in Forex. Investors may make a lot of money if they have strong market analysis abilities and correct information. The most crucial criteria in Forex are the quantity of money involved and the leverage.

The Turkish Citizenship by Investment Program was started in January 2017 with the goal of attracting foreign direct investment and boosting growth in the country's real estate industry. The program enables candidates to select from a variety of economic contributions to Turkish society, thus helping to strengthen the country's economy. However, real estate acquisition has been the most preferred method in this program. It's also the cheapest option: you and your family can obtain Turkish citizenship if you purchase a house worth at least $250,000.

Sources: invest.gov.tr / turkiye.gov.tr / goc.gov.tr

Editor: damasturk

2019

skilled workforce (Millions)

2018

skilled workforce (Millions)

The portfolio of real estate projects in DAMAS TÜRK is valued for unique characteristics, luxurious finishes, easy installment plans, and high discounts. Our residential projects are also distinguished with:

The guarantee of the Turkish government, suitable for Turkish citizenship, in vibrant and upscale areas.

Easy payment plans 12 - 120 months, discount on cash payments from 5 - 30%.

Our projects offer sea views, green views, smart apartments, near the metro.

The title deed is ready for delivery, luxurious finishes, large areas suitable for families.

Our residential projects are situated in Istanbul, Bursa, Antalya, and Ankara.

Our projects in Istanbul are located in the center, Başakşehir and Beylikdüzü.

For the lovers of nature, beauty, tranquility and relaxation, we offer a range of special villa projects in the Turkish coastal cities such as Istanbul and Antalya, with green views of the forests and mountains. All of our villa projects are suitable for Turkish citizenship, independent with privacy, have a private garden for each villa, and a security protection system for the complex. Our villa projects are located in quiet areas overlooking the Marmara Sea in Istanbul and Bursa. The prices of our villas in Kocaeli and Bursa start from 190.000 USD, in Antalya from 250.000 USD, and in Istanbul from 400.000 USD. Our villas range in style and design from 3 + 1 to 7 + 1 with spacious and comfortable living spaces, and multiple floors.

Some real estate marketing companies in Turkey promote this idea of resale guarantee, and it means: When a foreign investor buys a property in Turkey, the construction company guarantees the repurchase of this property from the investor after an average of 3 years, with the addition of a profit ranging between 20-35% of the property price. DAMAS TÜRK experts do not recommend this method, for the following reasons:

Turkey is known to be one of the countries with high annual inflation, and often the profit margin of the resale guarantee after 3 years is less than the official inflation rate, and therefore the investor will not make any profit when he exchanges his money to foreign currencies.

There is no legal provision in Turkey that obliges the seller to repurchase after 3 years, when the title deed (Tabu) has been transferred from the seller to the buyer.

DAMAS TÜRK experts advise foreign investors to invest in commercial real estate with high returns, or to buy and rent in vital areas near emerging government projects, which leads to a rise in the price of the property over time, and an acceptable profit from the rental return.

The amendments of the Turkish citizenship law generally include special facilities for foreigners to obtain the Turkish citizenship. And according to the recent law, Turkish citizenship is granted to foreigners in the following cases:

Purchase a property in Turkey with a value exceeding 400 thousand US dollars, instead of the previous value of 1 million US dollars, with a title deed restriction on its resale for at least 3 years.

Deposit of 500 thousand US dollars in the bank, instead of the previous value of 1 million US dollars stated in the previous law.

Invest in Turkey 500 thousand US dollars instead of the previous value of 2 million US dollars.

Offer job opportunities for 50 Turkish citizens instead of 100 citizens.

Special offices, which are subject to the oversight of the committee made up of the concerned ministries, will process and follow up applications for citizenship.

There are cheap properties in Turkey with prices starting from 20 thousand US dollars. Such option can be purchased and rented out to achieve a monthly profit.

- The exchange rate fluctuations of the Turkish lira, and the high rate of inflation in the country, which reached 14.2% in the year 2020.

- The difficulty of conducting transactions in official departments by oneself, due to the language barriers. Unless if you speak Turkish.

- The large number of marketing companies in Turkey, due to the large number of foreign communities in Turkey, brought about the spread of fraud and scams.

The best investment in Turkey is to invest in commercial real estate, by purchasing a store rented out to an international brand in a commercial mall with a minimum of 400.000 US dollars. By that, you can earn a rental return of 6-7% of the property price annually, you can acquire Turkish citizenship along with your family members under the age of 18, and finally you can consider reselling that commercial property after 3 years at a reasonable profit.

In all apartment sales in Turkey, Istanbul is consistently number 1, followed respectively by Antalya, Izmir, Ankara, and Mersin.

Iranians and Iraqis are in the vanguard of apartment purchasers in Turkey, as well as those from the Russian Federation, Afghanistan, Kuwait, Germany, and the United States.

This is owing to the strategic location of Turkey at a crossroads between Europe, the Middle East, and Central Asia. For real estate developers and investors, Turkey opens up a lot of possibilities. As well as Turkey's stability and the regulations that promote foreign ownership in Turkey, particularly with the possibility of gaining Turkish citizenship in return for property ownership in Turkey.

Since our beginnings, we have been striving to provide the most accurate and precise information and consultancy about the real estate market in Turkey.

Clients’ satisfaction is our priority